Advantages

A lower cost of business means higher profits for your company.

In addition to a central location and short travel times around the region, the cost of doing business in Kenosha County is often lower than its neighbors and is a key factor in companies like Haribo, Amazon, Uline, and Nexus Pharmaceuticals choosing to locate or expand their business here.

A state that is fiscally sound with competitive tax rates and a bevy of local and state financing and incentives make the case for choosing Kenosha County.

Doing Business in Kenosha County

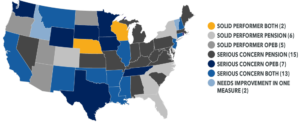

The State of Wisconsin is financially stable

Wisconsin has no structural deficit or major pending liabilities. It has a balanced state budget and is one of only two states in the nation with a fully funded pension system and no significant OPEB (other post-employment benefit) liabilities according to the PEW Center for the States.

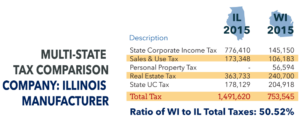

Favorable tax rates for manufacturers

Income, Property, and Sales Tax rates have been flat or declining for past five years in the state of Wisconsin.

The case study on the left describes an undisclosed manufacturer that evaluated Wisconsin and Illinois locations. The company had approximately 350 employees and $100 million in annual revenue. The data is an independent third party analysis from public accounting and consulting firm Baker Tilly Virchow Krause, LLP.

Wisconsin Tax Policy

“Kenosha County is one of the best kept secrets out there and they do a great job. The way the state’s trending, it’s very exciting to be a part of it. The move to Kenosha County was one of the best things we’ve ever done.”

– Tim Roberts

President & CEO,Catalyst Exhibits

Financing & incentives

KABA manages more than $30 million in community revolving loan funds. These funds are used to provide low-cost financing options to companies creating jobs in Kenosha County through expansions or by establishing a new facility in the area. We can also help determine if your company or project is eligible for local or state incentive programs.

Learn moreManufacturing Tax Credit

The Manufacturing and Agriculture Credit virtually eliminates the tax on income from manufacturing activity in the state. When fully phased in, the effective corporate tax rate for manufacturing and agricultural activities will be just 0.4 percent.

Learn moreCompetitive cost of living

The cost of living in Kenosha County is lower than the Chicago and Milwaukee Area. For example, the median home value in Kenosha County is $126,000 – in Lake County, Illinois, that figure jumps to $183,500. Kenosha County’s inbound migration rates are surging and its population is growing as people realize what a gem it is- and what a great value.

Top 10: ‘Best States for Business’

Wisconsin has leapfrogged nearly half the states in the country in Chief Executive magazine’s annual ranking of state business climates in recent years. It has surged from 41st place in 2010 to 10th in 2017; a 31 spot improvement in just seven years.

2017 Best & Worst States for Business